does square cash app report to irs

When you make a payment using a credit card on Cash App Square adds a 3 fee to the transaction. For small business transaction the Square Cash Pro does not have limitation on the amount you can transfer but do charge 275 on all business transactions.

Solved I Received A Phishing Scam Email About A Fake Disp The Seller Community

No need to check your mailbox we wont be sending a paper copy you can download your 1099-K form on the Tax Forms tab of your Square Dashboard.

. The 1099-B will also be available to download from your desktop browser at httpscashappaccount. For business payments the customer is charged 275. Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year.

Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS. Nothing to do with the transfer method currency etc. Does square report cash transaction made in their POS to IRS.

These payments can be made in two ways. Square Cash is ideal for small payments on the go between individuals or for payment of services and the minimum amount is as low as 1. 1 2022 users who send or receive more than 600 on cash apps must.

The Cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. Does The Cash App Report To Irs. Any errors in information will hinder the direct deposit process.

All financial processors are required to report credit card sales volume and then issue a 1099K I think its a K for that amount so that gets automatically reported to the IRS. Current tax law requires anyone to pay taxes on income over 600 regardless of where it. Certain Cash App accounts will receive tax forms for the 2018 tax year.

Here are some facts about reporting these payments. This is far below the previous threshold. Log in to your Cash App Dashboard on web to download your forms.

Cash App charges businesses that accept Cash App payments 275 per transaction. Log in to your Cash App Dashboard on web to download your forms. Standard transfers on the app to your bank account take two to three days and are free while instant transfers include a 15 fee.

It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account. By Tim Fitzsimons. E-filing is free quick and secure.

You can also apply for an EIN from the IRS. I believe they would have to get a warrant or supena or court order of some sort. Will the IRS receive a copy of my Form 1099-B.

Tax Reporting for Cash App. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. For any additional tax information please reach out to a tax professional or visit the IRS website.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. If you are using a cash app for business and make more than 600 a year in transactions the IRS wants to know. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year.

Herein does Cashapp report to IRS. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report cash app transactions to the feds. For any additional tax information please reach out to a tax professional or visit the IRS website.

Yes you will receive a 1099-K form next year if you receive more than 600 on an app. A business transaction is defined as payment. Cash App Taxes offers 100 free tax filing.

Can you transfer money from square to cash App. Filers will receive an electronic acknowledgement of each form they file. If you dont have an EIN you can apply for one with Squares free EIN assistant which guides you through the application.

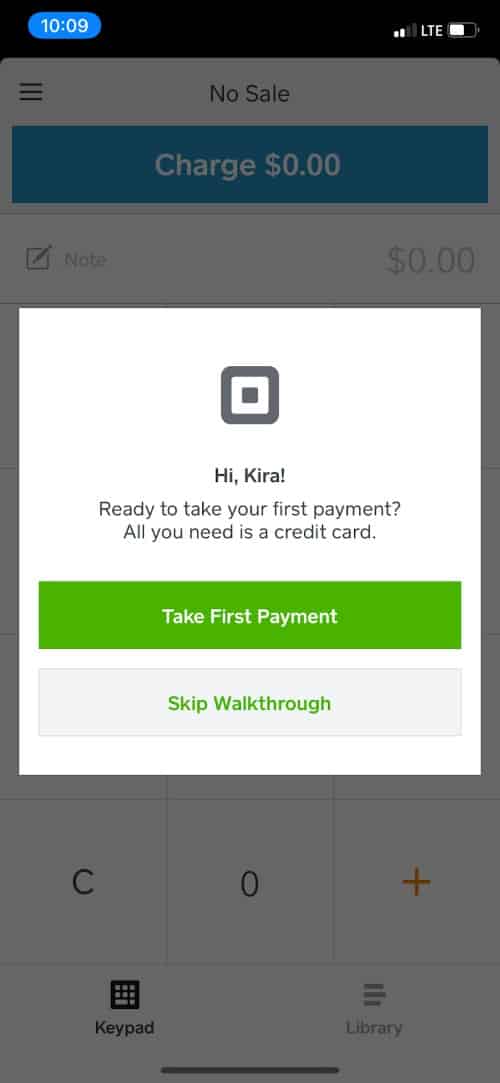

A Form 1099-K is the information return that is given to the IRS and qualifying. How to use Square Cash App. Tax Reporting for Cash App.

Square is required to issue a 1099-K and report to the IRS when you process 600 or more in credit card payments. However its not available for customers who need to file more than one state return had more than 600 of foreign income or received income. How is the proceeds amount calculated on the form.

An individual makes an in-application peer-to-peer payment to a business. Payments platform Square is now suggesting users deposit their COVID-19 stimulus payments through its Cash App for faster and easier access to the funds in the event someone doesn. Soon cash app earners will need to report to the IRS.

If your taxpayer information is associated with Massachusetts Vermont Maryland Washington DC or Virginia we are required to issue a Form 1099-K and report to your state when you accept 600 or more. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US. Cash App for Business accounts that accept over 20000 and more than 200 payments per calendar year cumulatively with Square will receive a Form 1099-K.

This only applies for income that would normally be reported to the IRS anyway. Where do I get my 1099-K form. If you have a Cash App account you are able to receive transfers.

Forms will be available by January 31st. Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules Cash App wont report any of your personal transactions to the IRS. Square is required to issue a 1099-K and report to the IRS when you process 600 or more in credit card payments.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Certain Cash App accounts will receive tax forms for the 2021 tax year.

Solved Everything You Need To Know About 1099 K Tax Forms Page 2 The Seller Community

Square To Buy Credit Karma Tax Biz For Cash App Expansion

Government To Tax Cash App Transactions Over 600 Youtube

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Summaries And Reports From The Online Square Dashboard Square Support Center Us

Form 1099 K Tax Reporting Information Square Support Center Us

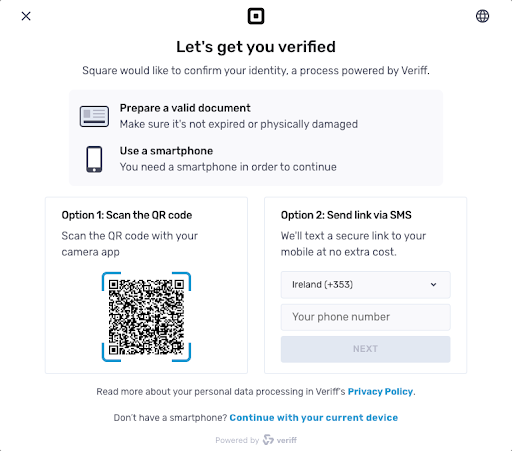

Required Documentation For Sign Up Square Support Centre Ie

Square Review Fees Complaints Lawsuits Comparisons

Granny Square Tutorial Granny Square Tutorial Patchwork Heart Granny Square

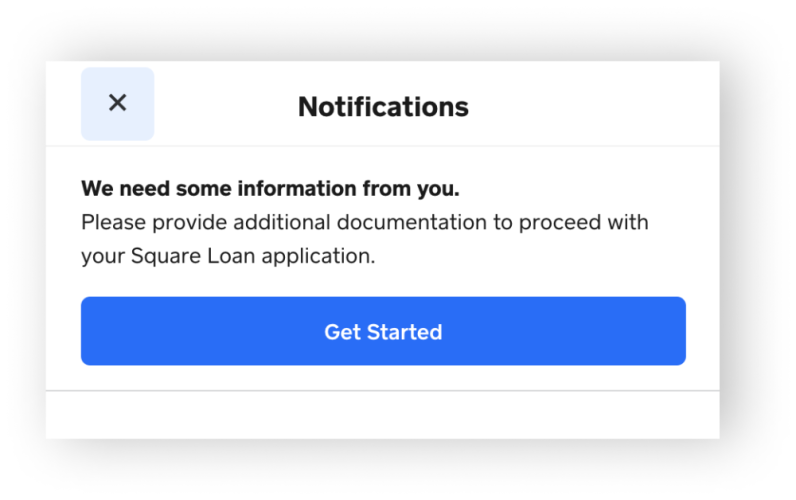

Information Requested For Square Loan Application Faq Square Support Center Us

The Ultimate Square Pos Setup Guide

Form 1099 K Tax Reporting Information Square Support Center Us

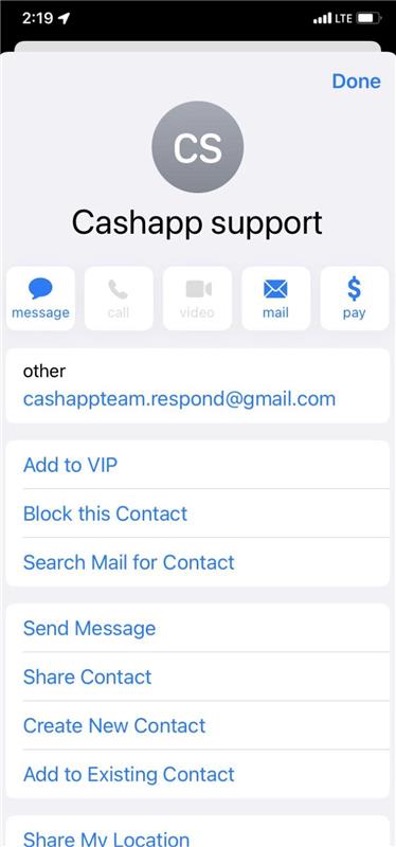

Top 3 Cash App Scams 2021 Fake Payments Targeting Online Sellers Security Alert Phishing Emails Giveaways Trend Micro News

Granny Square Tutorial Patchwork Heart Granny Square Tutorial Granny Square

Solved Your First Tax Season With Square The Seller Community